On April 24, 2017, the SAT released some modifications, additions and derogations to the General Rules of Foreign Trade 2017.

Ø Among the benefits for the automotive industry, the notice that companies or vehicle manufacturers present to the General Administration of Large Taxpayers to carry out the destruction of obsolete, damaged or useless merchandise was repealed. Likewise, the rule on withholding VAT on leases to foreigners was eliminated. (Rule 4.5.31)

Ø Companies with a canceled IMMEX program will now be able to submit a notice to extend the period granted by the Ministry of Economy to change the regime or return temporarily imported goods abroad to the ACAJACE to obtain a one-time extension of six months, counted at as of the expiration of the period granted by said Secretariat. (Rule 4.3.6)

Ø Annexes 1 "Foreign Trade Formats" were also modified; 1-A "Foreign Trade Procedures"; 10 “Sectors and tariff items”; 21 “Customs offices authorized to process the customs clearance of certain types of goods”; 22 “Instructions for filling out the Motion” and 26 “Inaccurate or omitted data from the Official Mexican Standards contemplated in rule 3.7.20”.

Ø Customs agents, importers and exporters must register with the ACAJA all bank accounts, through which they make payments, to facilitate the presentation of services. (Rule 1.6.3)

Ø In order to offer optimal performance in customs services inherent in the dispatch of merchandise and thus promote greater efficiency in the flow of international trade, there will be schedules for entry into national territory for certain fractions. (Rule 2.1.2)

Ø The companies of the automotive industry that are located in the border strip or region and that dispose of parts and components to the companies of the terminal automotive industry or manufacturing of motor transport vehicles located in the rest of the national territory, may carry out transfers of said merchandise to the rest of the country, provided they present the form "Notice for the transfer of auto parts to the terminal automotive industry or manufacturing of motor transport vehicles" before the ACAJACE. (Rule 4.3.10)

http://www.sat.gob.mx/informacion_fiscal/normatividad/Documents/1er_RMRGCE_240417.pdf

President Donald Trump signed an executive order on April 18, 2017 for federal agencies to apply the rhetoric "Buy American, Hire American"

This order seeks to strengthen the protections of certain products made in the United States. Trump said this would help aggressively promote and use US-made goods

The executive order, however, takes no direct action to fundamentally change either party, instead initiating a series of reviews and evaluations and calling on federal departments to begin proposing program reforms. The order would send a clear signal to federal agencies responsible for enforcing programs that the administration wants to see a more aggressive stance, authorities said.

Federal agencies must evaluate their compliance with Buy American laws, since the use of waivers is affecting domestic jobs and manufacturing.

The "buy American" portion of the order directs agencies to conduct a "top-down performance review" of the use of the exemptions and calls for stricter enforcement laws regarding the purchase of US-made goods by the federal government and the use of US-made iron and steel in federally supported projects.

"We are in a global competition for jobs today, and the best way to make America successful in this environment is to arm our people with the technical capabilities to win that global competition for prosperity," said Nicholas Pinchuk

Also within 150 days, the Department of Commerce and the Office of the United States Trade Representative must assess the impacts of all United States Free Trade Agreements and the World Trade Organization Agreement on Government Procurement on the Buy American law operation.

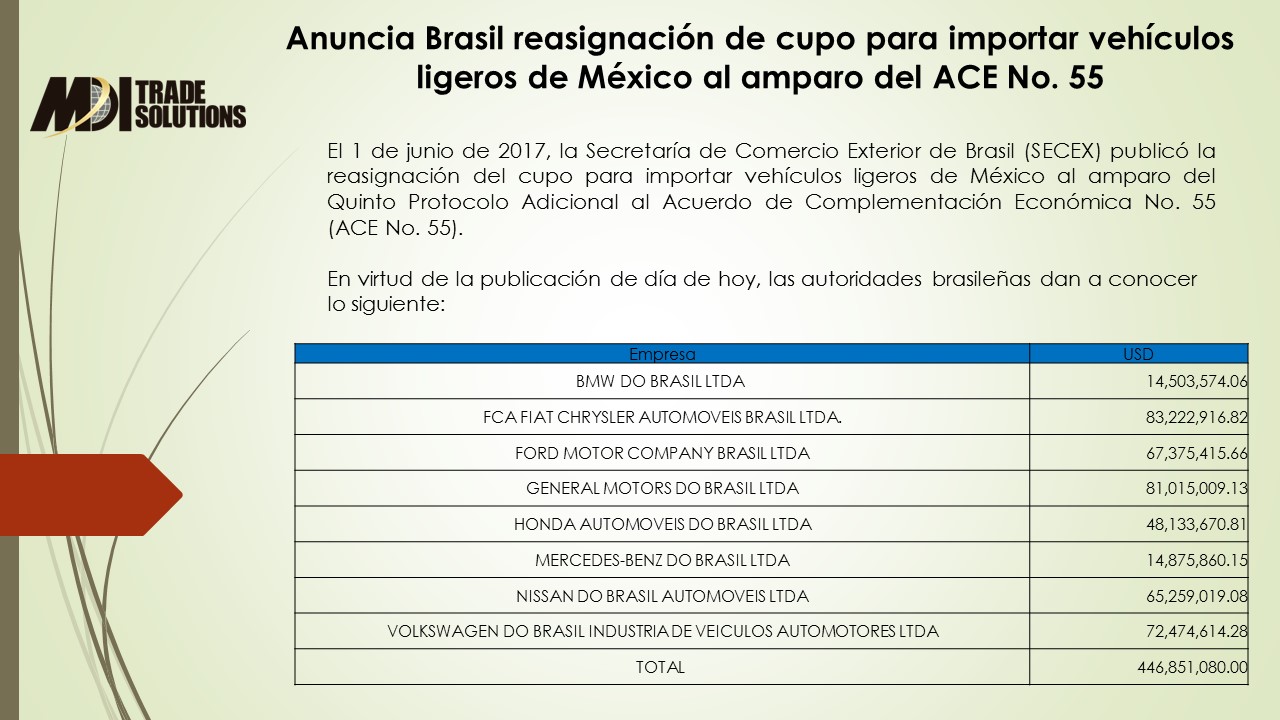

- Sixth Additional Protocol to Appendix II of the Agreement on Economic Complementation No. 55 (ACE No. 55)

- AGREEMENT that modifies the diverse one that determines the rules for the application of the Decree to support the competitiveness of the terminal automotive industry and to promote the development of the domestic automobile market.

- AGREEMENT that modifies the diverse one that determines the rules for the application of the Decree to support the competitiveness of the terminal automotive industry and to promote the development of the domestic automobile market. (2)

- General rules and criteria in Foreign Trade matters issued by the Ministry of Economy